The Goods and Services Tax Identification Number (GSTIN) is a unique 15-digit identifier introduced by the Government of India on July 1, 2017. This tax, commonly known as GST, was implemented to enhance transparency and streamline the tax collection system for both goods and services. The objective was to replace various state and central taxes, creating a unified tax structure across the nation, adhering to the principle of “one tax in one nation.”

Before the introduction of GST, businesses were assigned a Tax Identification Number (TIN) by State Tax departments. However, with the advent of GST, the TIN system has been replaced by GSTIN. This 15 digit identifier is PAN-based and is obtained through the GST Registration Process, overseen by the GST authority. All legal taxpayers are now mandated to register under the authority of GST, ensuring a standardized and centralized tax identification system.

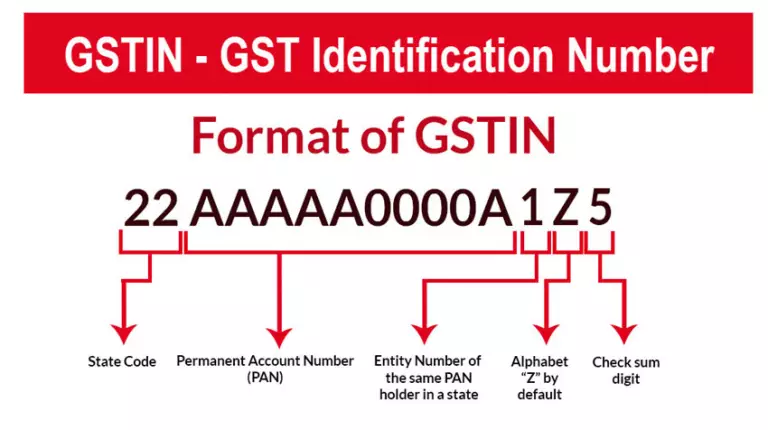

Format/Features of a GSTIN

The Goods and Services Tax Identification Number (GSTIN) in India follows a specific format and includes various features. Here is the breakdown of the structure of a GSTIN:

- State Code: The first two digits represent the state code. Each state in India has a unique code assigned to it.

- Entity Code: The next ten digits represent the entity code, which is a combination of the PAN (Permanent Account Number) of the taxpayer. This ensures uniqueness across the country.

- Entity Type: The thirteenth digit signifies the entity type. It distinguishes between different types of entities like regular taxpayers, composition dealers, etc.

- Check Digit: The last digit is a check code calculated using a specific formula, providing a built-in mechanism for error detection.

Here’s an example of the GSTIN format:

XXABCDEFGH123Z9

XX: State Code

ABCDEFGH123: PAN-based Entity Code

Z: Entity Type

9: Check Digit

It’s important to note that the GSTIN is a 15-digit alphanumeric code, and each part of the code serves a specific purpose in identifying the taxpayer and ensuring the accuracy of the GSTIN.

How To Verify GST Identification Number Online Instantly?

The process for verifying GSTIN (Goods and Services Tax Identification Number) in India involved using the official GST portal. Please note that procedures and websites may have been updated since then, so it’s advisable to check the latest guidelines on the official GST portal or related government websites. As of my last update, here are the general steps for verifying GSTN online:

- Visit the GST Portal:

Go to the official GST portal: https://www.gst.gov.in/. - Navigate to “Search Taxpayer”:

Look for the “Search Taxpayer” option on the GST portal. This is typically available on the homepage. - Enter GSTIN:

Enter the GSTIN that you want to verify in the provided field. - Security Captcha:

Complete the security captcha or any other verification step as required. - Click on “Search”:

Click on the “Search” button to initiate the verification process. - View Results:

The system will display the details associated with the provided GSTIN if it is valid. This may include the legal name of the business, the state code, and other relevant information. - Verify Details:

Check the displayed information against the details you have to ensure accuracy.

It’s important to mention that you should always use the official GST portal or government-approved channels for GST verification to ensure the authenticity of the information.

Keep in mind that procedures may have changed, and it’s recommended to refer to the latest guidelines and updates from the official GST authorities or contact them directly for the most accurate and current information.

How To Apply For GST Identification Number ?

You can register for GST and obtain a GSTIN for free –

Log in to gst.gov.in

As part of the GST REG-01 form, fill out the following pages-

- Business details

- Promoter/ partners

- Authorized Signatory

- Authorized Representative

- Principal Place of business

- Additional place of business

- Goods and services

- Bank Accounts

- State-specific Information

- Verification.

After submitting the form, you will receive an e-mail and SMS about the submission of the registration application with a 15-digit Application Reference Number.

After verification in the GST portal, the application might get rejected or approved, or further documents might be demanded.

If more clarification is required, a Show Cause Notice Reference Number will be provided, using which you will have to log into the portal, navigate to the exact page demanding clarification and use the same to upload documents.

Once your new Registration Application is verified and approved in the GST portal, you will get a 15-digit unique (GSTIN) along with a temporary password which can be reset after the first login.

Importance of a GST Identification Number

The Goods and Services Tax Identification Number (GSTIN) is of significant importance in the context of the Goods and Services Tax (GST) regime in India. Here are several reasons highlighting the importance of GSTIN:

- Legal Recognition:

GSTIN provides legal recognition to businesses for the purpose of collecting and remitting GST. It is a mandatory registration for businesses whose turnover exceeds the prescribed threshold. - Unified Tax System:

GSTIN is a key element in the implementation of a unified tax system in India, replacing various state and central taxes. It helps streamline tax administration and promotes the idea of “one

nation, one tax.” - Transparency:

The use of GSTIN enhances transparency in the tax system. It enables authorities and other businesses to easily verify the registration status and details of a taxpayer. - Input Tax Credit (ITC):

GSTIN is crucial for businesses to claim Input Tax Credit. It ensures that the tax paid on inputs is credited throughout the supply chain, leading to a reduction in the overall tax burden on the final consumer. - Inter-State Transactions:

For businesses engaged in inter-state transactions, GSTIN is essential. It helps in determining the place of supply and facilitates the appropriate tax treatment for transactions between states. - Compliance Requirements:

GSTIN is necessary to comply with various legal and compliance requirements under the GST law. Businesses need to file regular GST returns and maintain proper documentation, and GSTIN is a key identifier in these processes. - Avoidance of Duplicate Registrations:

GSTIN, being a unique identifier, helps prevent duplicate registrations. Each registered taxpayer is assigned a unique GSTIN, reducing the likelihood of multiple registrations for the same entity. - E-commerce Transactions:

For businesses engaged in e-commerce, GSTIN is critical. E-commerce operators and sellers on e-commerce platforms need to be registered and use GSTIN for compliance and reporting purposes. - Government Initiatives:

Government initiatives and benefits often require GST registration. For example, certain business schemes, subsidies, or financial assistance programs may be linked to GSTIN. - Business Credibility:

Having a valid GSTIN can enhance the credibility of a business. It signifies that the business is compliant with tax regulations and is part of the formal economy.

In summary, GSTIN is a fundamental component of the GST system in India, providing legal recognition, promoting transparency, facilitating compliance, and ensuring the smooth functioning of the unified tax structure. It is a key identifier for businesses participating in the GST regime.

How to Calculate GST?

The Goods and Services Tax (GST) system in India involves different rates for various goods and services. The GST calculation in India depends on whether it’s an intra-state (within the same state) or inter-state (across different states) transaction.

Here are the steps to calculate Indian GST:

For Intra-State Transactions (Within the Same State):

- Identify the GST Rates:

Determine the applicable GST rates for the specific goods or services. GST rates can vary, such as 5%, 12%, 18%, or 28%. - Understand CGST and SGST:

For intra-state transactions, GST is split into Central GST (CGST) and State GST (SGST). Each is calculated as a percentage of the taxable value. - Determine Taxable Value:

Identify the taxable value, which is usually the transaction value, excluding other taxes, discounts, or charges. - Calculate CGST and SGST:

Use the following formulas:

CGST Amount=(CGST Rate100)×Taxable ValueCGST Amount=(100CGST Rate)×Taxable Value

SGST Amount=(SGST Rate100)×Taxable ValueSGST Amount=(100SGST Rate)×Taxable Value - Total Amount Including GST:

Add CGST and SGST to the taxable value:

Total Amount = Taxable Value + CGST Amount + SGST Amount Total Amount = Taxable Value + CGST Amount + SGST Amount

For Inter-State Transactions (Across Different States):

- Identify the GST Rate (IGST):

In inter-state transactions, Integrated GST (IGST) is applicable. Identify the IGST rate applicable to the specific goods or services. - Determine Taxable Value:

Identify the taxable value, which is usually the transaction value, excluding other taxes, discounts, or charges. - Calculate IGST:

Use the following formula:

IGST Amount=(IGST Rate100)×Taxable ValueIGST Amount=(100IGST Rate)×Taxable Value - Total Amount Including IGST:

Add IGST to the taxable value:

Total Amount=Taxable Value+IGST AmountTotal Amount=Taxable Value+IGST Amount

Example:

Suppose you have an intra-state transaction with a taxable value of ₹1,000, and the applicable CGST and SGST rates are both 9%.

CGST Amount=(9100)×1000=₹90CGST Amount=(1009)×1000=₹90

SGST Amount=(9100)×1000=₹90SGST Amount=(1009)×1000=₹90

Total Amount=₹1,000+₹90+₹90=₹1,180Total Amount=₹1,000+₹90+₹90=₹1,180

For inter-state transactions, the process is similar, but you would calculate IGST instead of CGST and SGST.

Please note that the GST rates and rules may have changed since my last update, so it’s advisable to check the latest guidelines on the official GST portal or consult with a tax professional for the most accurate and up-to-date information.

Benefits of Getting a GSTIN

Getting a Goods and Services Tax Identification Number (GSTIN) in India offers several benefits for businesses and individuals. Here are some key advantages:

- Legal Recognition:

GSTIN provides legal recognition to businesses and individuals as registered taxpayers under the Goods and Services Tax (GST) system. It is a mandatory requirement for businesses whose turnover exceeds the prescribed threshold. - Unified Tax System:

Obtaining a GSTIN allows businesses to participate in the unified tax system in India. It replaces various state and central taxes with a single tax structure, promoting the idea of “one nation, one tax.” - Input Tax Credit (ITC):

With a valid GSTIN, businesses can claim Input Tax Credit (ITC). This means that the tax paid on purchases of goods and services can be offset against the tax payable on the supply of goods or services. It reduces the overall tax burden on the final consumer. - Inter-State Transactions:

For businesses engaged in inter-state transactions, having a GSTIN is essential. It helps in determining the place of supply and ensures compliance with the appropriate tax regulations. - E-commerce Transactions:

Businesses involved in e-commerce activities, either as operators or sellers on e-commerce platforms, need a GSTIN. It is a prerequisite for registration and compliance in the digital marketplace. - Legal Compliance:

Having a GSTIN ensures compliance with the legal requirements of the GST law. It involves filing regular GST returns, maintaining proper documentation, and adhering to the rules and

regulations set by the tax authorities. - Avoidance of Duplicate Registrations:

GSTIN, being a unique identifier, helps prevent duplicate registrations. Each registered taxpayer is assigned a unique GSTIN, reducing the chances of multiple registrations for the same entity. - Government Initiatives and Benefits:

Some government initiatives, subsidies, or financial assistance programs may be linked to GST registration. Having a GSTIN makes businesses eligible for such schemes and benefits. - Business Credibility:

Possessing a valid GSTIN enhances the credibility of a business. It signifies that the business is compliant with tax regulations and is part of the formal economy. - Facilitates Business Growth: GST registration and the possession of a GSTIN can open up new business opportunities and partnerships. Many businesses prefer to deal with GST-registered entities, and having a GSTIN can enhance the market reputation of a business.

In summary, obtaining a GSTIN is not just a regulatory requirement; it brings several operational and financial benefits. It streamlines the taxation process, promotes transparency, and ensures that businesses contribute to the formal economy in a standardized manner.

Conclusion

GSTIN is an important point for legal hindrance-free business across the country. This article clearly summarises the format, verification, importance, and process to calculate GST.

Reference Links

- https://vakiltrust.com/gst/classification-under-gst-role-of-hsn/

- https://vakiltrust.com/uncategorized/gst-council-to-regulate-gold-transportation/

- https://vakiltrust.com/uncategorized/pav-urges-finance-minister-to-eliminate-gst-on-essential-medicines/

- https://vakiltrust.com/gst/gst-regime-and-its-impact/

- https://vakiltrust.com/gst-registration/